The Performance of listed steel enterprises decline

The total profit of 35 listed steel pipe suppliers monitored by Lange steel research center in the first half of 2019 exceeded 32.81 billion yuan, down 38.2% year on year. Among them 34 enterprises maintain profit, only 1 enterprise has a loss. The top three enterprises were baosteel, valin and minguang, with net profits of 6.19 billion yuan, 2.24 billion yuan and 2.17 billion yuan respectively. The top three enterprises with fast growth of net profit were xining special steel, ST fu steel and jiuli special materials, with growth of 365.1%, 280.5% and 59.3% respectively in the first half of the year. The 35 steel companies listed in the first half of the year, 10 reported positive year-on-year net profit growth, up two from the first quarter. Among them, ST fu steel, jiugang hongxing and daye special steel turned from negative growth in the first quarter to positive growth, while zhongyuan special steel turned from positive to negative growth. The net profit of the other 25 enterprises declined year on year in the first half, accounting for 71% of the total enterprise.

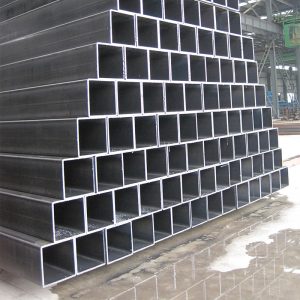

A sharp rise in iron ore prices in the first half of the year, resulting in a marked rise in costs of structural steel pipe, combined with a slight decline in steel prices this year compared with the same period last year, which has led to a fall in profits. The average price of steel in China in the first half of this year was 4,174 yuan per ton, down 3.9 percent year on year, according to monitoring data from Lange steel cloud business platform. During the same period, iron ore, coke and other raw fuel prices rose, making steel costs significantly higher. In the first half of 2019, the average unit price of iron ore imports by the customs was us $86.65 / ton, up 23.3% year on year. The average price of secondary metallurgical coke in Tangshan was 2005 yuan/ton, up 2.0% year on year. The cost of galvanized steel pipe measured by Lange steel research rose 7.8 percent in the first half from a year earlier.

Anyang steel said in its results that the company’s profit level fell year on year as steel market prices fell and iron ore prices rose sharply, coal and scrap prices remained high. At the same time, the company’s previous annual loss has been made up, according to the provisions of the tax law, resulting in a decrease in net profit. In the fourth quarter, as the market demand of China hollow section tube gradually into the off-season, steel mills profit is likely to continue weakening.

Tel: +86 18202256900 Email: steel@fwssteel.com