Market trend of rebar

Since the opening of the Spring Festival, the main contract price of rebar futures has been adjusted back to more than 200 yuan/ton and the price of hot coil has also been adjusted back to more than 100 yuan/ton. The recent rapid decline in rebar steel futures is mainly due to: inventory accumulation exceeded expectations, continuous rain and snow weather caused by lagging demand for structural steel pipe, market mentality. One or two weeks after the Spring Festival, steel demand, especially steel rebar demand is weak and the situation of oversupply is obvious. At this time, the main factors affecting the price trend of steel rebar is: inventory change, the actual demand start, market expectations.

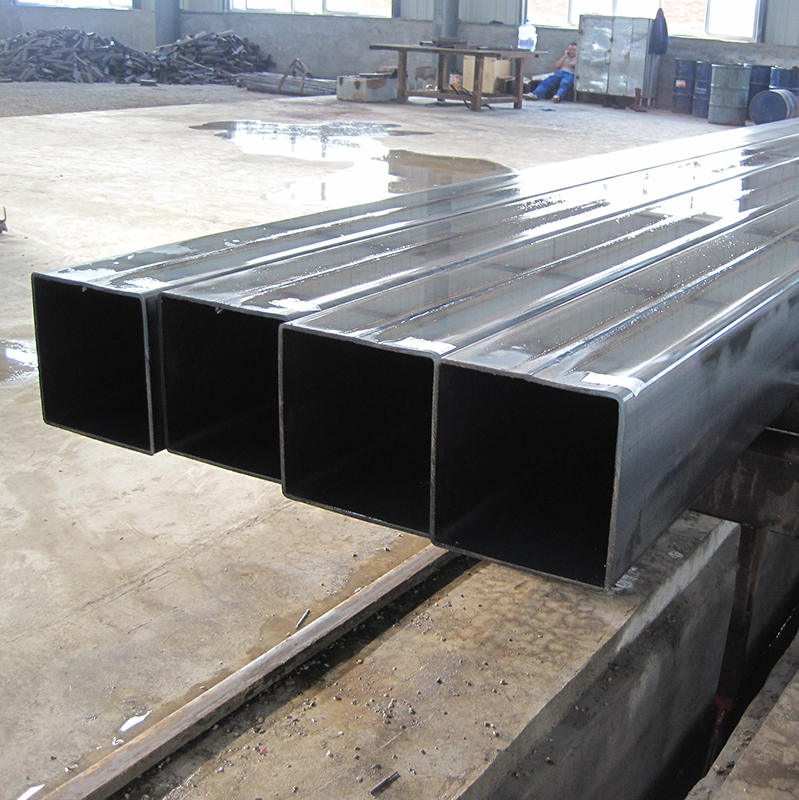

In fact, the domestic and foreign macro environment during the Spring Festival is not bad, there are few new negative factors and the macro is generally positive. However, the poor weather conditions affect the inventory accumulation. Coking coal and coking coal futures have been trading at low levels since December with little upside, while import restrictions of Australian coking coal have bolstered confidence in the coking coal market. Due to the need for steel restocking, coupled with high energy consumption, raw material prices are usually relatively strong in winter. Since the last quarter of last year, the relaxation of production restrictions on environmental protection has led to strong demand for raw materials, but steel supply for mild steel tube remains high. As demand has not kept up with the situation, the raw material market is strong and steel prices downward is normal.

Recent rebar futures is a concussion trend and the fluctuation range is limited. At the same time, the futures trend of raw materials such as iron ore, coke and coking coal will continue to be stronger than that of raw materials, so steel pipe manufacturers can adopt the strategy of multiple raw materials. In the future, there will still be a certain range of rain and snow weather, which will bring some interference to the real start of steel demand. In the case of insufficient demand, supply did not see a significant decline and inventory growth of social steel will continue. Similarly, there is no reason for steel prices to plunge in the near term. On the demand side, the government has approved a large number of infrastructure projects since January, and real estate investment remains at a high level. From the perspective of supply for hot-rolled steel pipe, steel pipe suppliers did not have the conditions to start construction, which suppressed the growth of supply.

Tel: +86 18202256900 Email: steel@tjdpbd.com