According to the European Steel Review, a November edition of the European Steel Review by European parliamentarians, the price base for Steel mills in most European markets is relatively stable. Big steel mills continued to push for further price increases, but buyers barely reacted. Still, steelmakers are confident that a modest price increase will take effect in early 2018. Although the distributor has successfully digested the overinflated inventory, there is no immediate buying pressure. However, supply has tightened as a result of trade measures. This, together with solid underlying consumption, continues to support manufacturers’ recommendations.

German manufacturing continued to grow strongly at the beginning of the fourth quarter. Steel consumption remains strong and car and construction companies need a lot of steel. The import quantity is mainly limited to small tonnage. Despite the lack of competitive overseas opportunities, buyers see the availability of domestic sources as sufficient to meet their needs. Benchmark prices remained largely unchanged in November, still falling short of targets set by local steel mills.

Prices in France are relatively stable. Demand is pretty good, even though orders were low in October. Buyers, who had expected prices to fall, have resumed buying. While steel mills continue to recommend increased production, customers expect no change until the end of the year.

In Italy, most fourth-quarter deals have now been finalised and prices are on par with last month’s record. There is a certain degree of uncertainty in forward pricing. Buyers are waiting for large orders. In fact, some major service centers are still preparing for the end of the year. The new import agreement is almost nil. Offers from Turkey, India and Vietnam are close to European levels.

Despite the calm in the UK market, some service centres reported a rise in activity levels in early November. The outlook for manufacturing remains positive, but car production is slowing and construction activity is falling sharply. Resale profits continue to be a problem for distributors as lower-priced old inventories continue to play a role in the supply chain. Producers have been slow to release a target price for the first half of 2018 after noticing a recent drop in trading volumes.

Demand in Belgium is strong, and while sales are shrinking, the need to reduce inventory levels by the end of the year is taking into account. The product base value of steel strip mill is stable at present. The supplier recommends a small increase in production in January 2018. However, distributors do not believe current demand justifies further rate increases. They are already struggling with their resale margins. Import prices in third countries are no longer attractive.

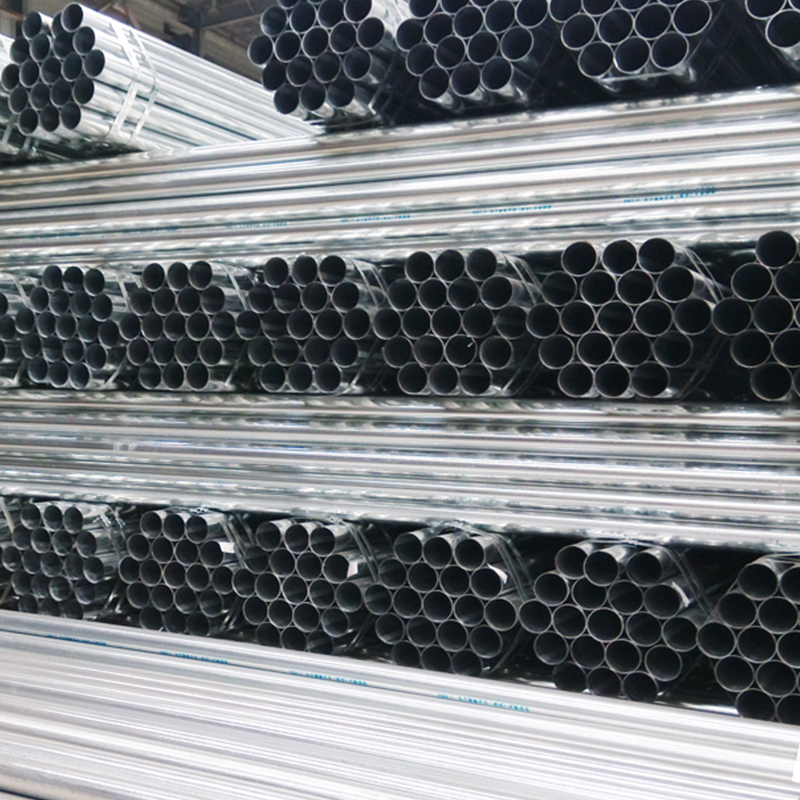

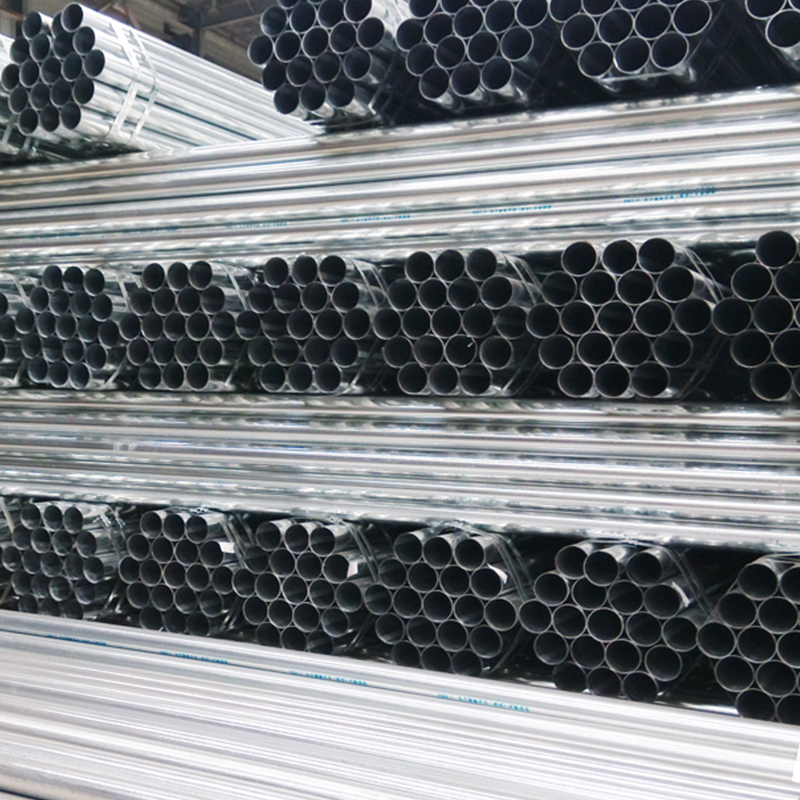

Spanish manufacturing grew further in October. The demand for strip mill products is stable. The underlying value remained stable in November. Orders from local mills are unlikely to improve much in the near term. A large number of imported materials, especially cold rolling and galvanized coils,cold galvanized steel pipe , are still arriving at a time when overseas prices are very competitive. New import quotations were resumed this month. Activities at the service center are rather slow.

What about the situation in China market now?If you want to see me information about steel ,especially steel pipe China,China emt conduit,please see the website.