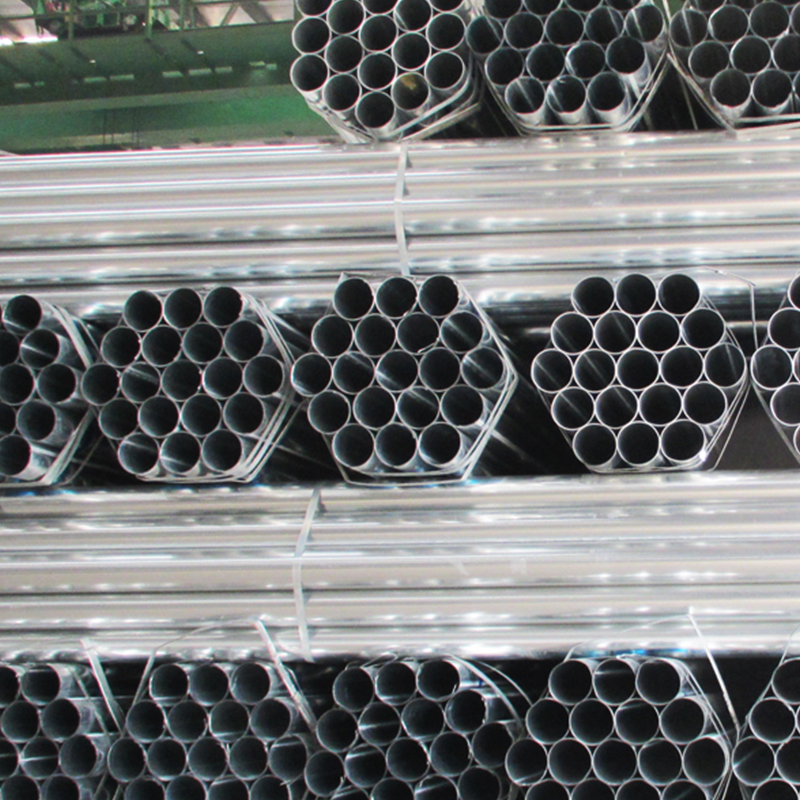

pre galvanized piping suppliers will increase production

The surge in profits is having a new impact on the domestic steel industry environment. Incomplete statistics by financial journalists found that 29 listed steel pipe companies especially for pre galvanized piping suppliers had issued annual reports, of which 3 are expected to increase slightly, 2 are expected to turn around, 1 is expected to continue to lose, 1 is expected to continue to gain, and the remaining 22 are all expected to increase. In terms of the specific amount of profit, the nearly 20 billion yuan of profit shares the highest amount of net profit from baosteel, while other steel enterprises also have very rich net profit. There is no doubt that 2017 has been a good year for the steel industry.

Under the influence of supply-side reform and measures like cleaning up “inferior steel pipe “, the industry keeps developing well and becomes the main reason for the growth of every steel enterprise such as mild steel tube manufacturers.Relevant data show that China’s steel industry achieved a complete capacity reduction of 115 million tons in 2017, which has exceeded the bottom line of 100 million tons of steel production capacity in five years. The improvement of the environment makes the profit per ton of steel produced by the pre galvanized piping suppliers have hundreds of yuan, which will surely spur steel companies to try to increase production.

Profits have driven steel mills to ramp up production and demand for structural steel pipe has surged and inventories at pre galvanized steel pipes are at record highs. Although the inventory of iron ore ports was at a high level throughout 2017, the volume is still at a new high.Iron ore port stocks have been growing for months. However, despite the jump in profits since 2017, steel companies will be prompted to increase the power to release capacity.But from the overall iron ore market in 2018, the pattern of iron ore oversupply has not changed.

China’s iron ore imports will be around 1.1 billion tonnes in 2018, a growth rate of only about 2 percent.In terms of iron ore prices, a sustained rise in iron ore prices in 2018 is unlikely, and some decline is expected. Pre galvanized piping suppliers as well as hollow section manufacturers are also pessimistic about the operation of the iron ore market in 2018, with Australia reporting in January that the average price of iron ore will fall to $51.50 per tonne this year, down 20 per cent from its forecast for 2017.

Tel: +86 18202256900 Email: steel@fwssteel.com